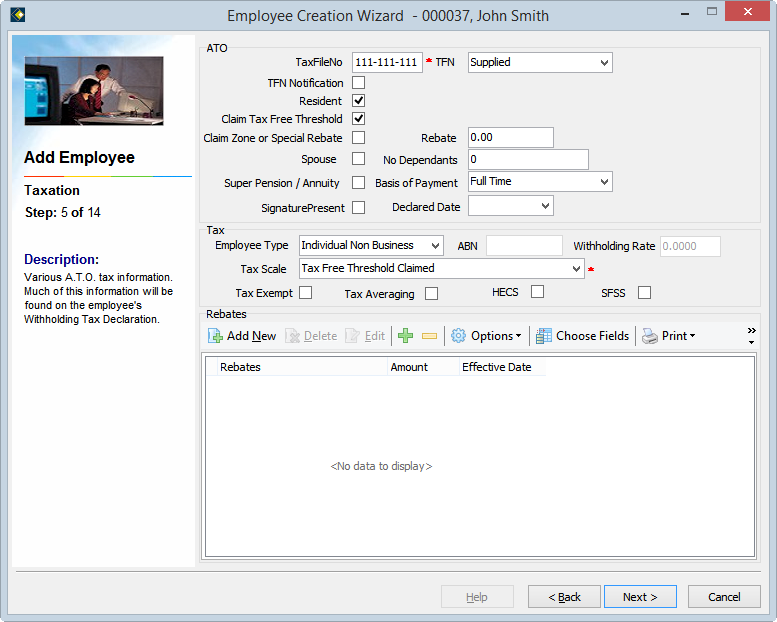

Step 5: Taxation

At Step 5 you are able to define taxation details for this employee. To satisfy ATO requirements, you should complete as much of this screen as possible.

The information on this screen is used to:

- Electronically record an employee's TFN declaration.

- Electronically supply employment declaration information to the ATO.

- Calculate an employee's withholding tax throughout the financial year.

- Calculate any rebates which may be applicable for this employee.

There are three main sections on this screen:

ATO

This section records the employee's selections in the TFN declaration provided when they commence employment. This information is required for the ATO, and is included in the electronic PAYG declarations generated by payroll.

The fields in this section are described in Maintaining Employees | Tax | ATO section.

Tax

This section holds information used by payroll to calculate this employee's tax contributions. If required, tax variations can be set up later on the tax tab of the Employee File.

The fields in this section are described in Maintaining Employees | Tax | Tax section.

Rebates

This section deals with any rebates this employee is claiming.

The fields in this section are described in Maintaining Employees | Tax | Rebates section.

Go to Step 6.